Daniel Connell Ph.D., Energy Markets Analyst, ZTP

“In the midst of chaos, there is also opportunity.”

Sun Tzu, The Art of War

The key balance within the risk-reward spectrum, as posited by Tzu 2,500 years ago, has been a constant component of geopolitical wrangling ever since. Wars have lasted decades and days; maps and territories drawn, lost, and re-plotted. Global conflict – the spectre of a potential “war to end all wars” – hung over the first half of the twentieth century, only to be superseded by the Cold War: an intense decades-long dance of brinkmanship and détente that brought us to the brink at the Bay of Pigs, but also in effect took us to the moon.

Conflict, chaos and innovation go hand in hand so smoothly not only because the latter two are almost always a consequence of the first; it is also the case that conflict can be caused by innovation. And in our post-Cold War, post-Soviet Union world, where China has risen to the rank of global superpower, the lines have never been so blurred.

One key area of intrigue is liquefied natural gas (LNG).[1] Here, a long history is only recently starting to cause a significant impact. Innovation came long before conflict.

Tzu also said that the pinnacle is to break an enemy’s will without needing to fight them; on the geopolitical stage this is done in several ways: resource allocation; economic prosperity and security; and finally, global influence. Years of globalisation and multi-national conglomerates tethered by visible and invisible strings to national interests have shaped new quasi-battlegrounds. Namely, in energy.

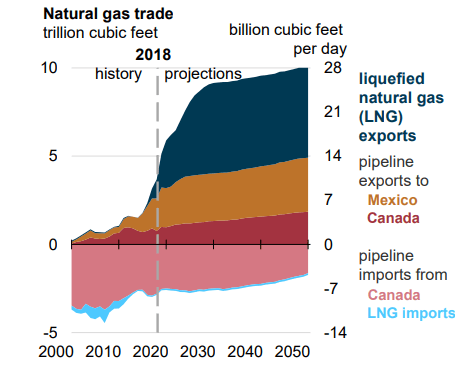

Global LNG exports increased 60% in the last decade. Russia and Australia multiplied their 2010 output, whilst the US went from bit-part to considerable player over the decade. A minority route to energy became very crowded in a short space of time, as tankers got bigger and new LNG plants opened across the world.

| LNG Exports | |||

| Billion Cubic Metres | 2010 | 2019 | Change: |

| Global | 302.39 | 483.33 | 60% |

| Australia | 25.84 | 104.47 | 304% |

| Qatar | 77.83 | 105.56 | 36% |

| Russia | 13.48 | 38.70 | 187% |

| US | 1.45 | 49.60 | 3,321% |

Table 1: LNG Exports. Sources: BP Statistical Review 2019, Reuters The scale has become such that LNG now rivals imports and domestic production in the UK; a European record 698GWh was sent out from Isle of Grain terminal on 14 November 2019, showing

the ability of that route to challenge traditional fields and pipelines. It even constitutes a viable source of supply balance to challenge Mid-Range Storage (MRS), which has been noticeably full in the UK and Europe as the LNG continues to flow.

So, where is the conflict?

Enter Russia – via Nord Stream, Ukrainian pipelines, and the soon-to-go live Nord Stream [2]. To get a sense of how each part is connected, we must go back to 2009, when a dispute between Russian company Gazprom and Ukrainian company Naftogaz over debt saw gas supplies to Europe cut. Whilst many countries were prepared for such an occurrence, after a similar incident in 2006, the effect was still profound. Europe’s reliance on Russian gas required a level of trust in supply that was severely eroded by these arguments; hence the first pipe of Nord Stream was laid in 2010. [1] Supplying gas from Russia to Europe via a sub-sea pipeline to Germany, Nord Stream surpassed Norway’s Langeled pipeline as the longest in the world. With a total annual capacity of 55 billion m3, it combined with a newly minted Russia-Ukraine natural gas agreement as part of the April 2010 Kharkiv Pact to solidify Russia’s position as the key supplier of gas to Europe.

The annexation of Crimea in 2014 saw the pact dismantled, though the 10-year agreement on gas supply remained intact; one curiosity was Ukraine’s refusal to purchase gas directly from Gazprom, instead transiting it to Europe and then purchasing it from European sources via reverse flows. With concerns about the viability of sustained Ukrainian transit persisting, a project titled Nord Stream 2 – two additional lines that would double the flow capacity of the original Nord Stream – went ahead. Political controversy ensued – particularly from the US, who placed sanctions on companies directly involved in the project’s implementation. The inclusion of these punitive measures within the National Defense Authorization Act for Fiscal Year 2020, released 20 December 2019, raised eyebrows in Germany, with German Finance Minister Olaf Scholz calling them “…a severe intervention in German and European internal affairs.”[3

] Why would the US take such action, given Russia’s stranglehold on European supply?

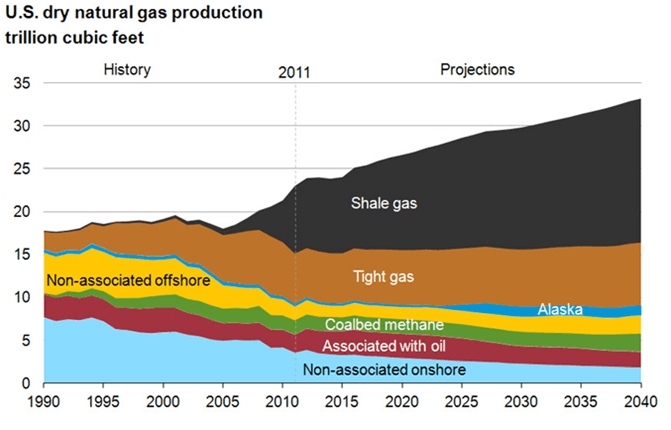

In short, shale gas production.

A relative boom in the US, back to 2000 but really picking up pace by 2007, has had a transformative effect on the energy landscape in America. LNG import terminals – such as Freeport, in Texas – started to look outward rather than in, transforming to an export facility. With the expansion of proved reserves giving the US product with largely untapped availability, there was only one likely route of expansion for delivery of this: via LNG.

With the US Energy Information Administration (EIA) estimating US net natural gas exports to nearly double by 2021, mostly through increase in LNG, the first piece of the jigsaw shaping why the US would oppose a strengthening Russian grip on Europe becomes clear: they have product to shift. However, with their targeted markets clearly Asia and parts of the Americas – and demand growth forecast to escalate in non-OECD countries – why would a virtually already-claimed Europe be so important to the US?

To get our answer, we look to the Pacific. More specifically, to the Japan Korea Marker (JKM for short). This refers to the spot market value of cargoes delivered ex-ship into Japan, South Korea, China, and Taiwan. It reflects the majority of global LNG demand, its trade liquidity growing dramatically since its inception in 2009. This means that it is often used as the basis for trades around the world. Set up originally on mostly long-term contracts – generally indexed to Brent oil prices to provide stability – recent years have seen a shift to shorter terms and spot markets since the original contracts ceded. This meant that as the market developed past five years from foundation, price action saw more fluctuation and, vitally, huge reductions as supply became more competitive.

This battle saw many companies reduce their dependency/usage via the stable but high-priced oil-indexed contracts, attracted to the savings the spot market offered. This saw imports grow considerably, from approximately 250bcm in 2009 to over 400bcm in 2018. The demand naturally brought innovation and development forward, with major players like Australia, Malaysia and the US all developing facilities primed for LNG exports.

Prices plummeted as the tether to oil loosened. Whilst this increased interest from parties stuck in indexed contracts, it had another effect: the LNG tankers looked to other markets. A complex gas storage dynamic developed in the UK and Europe as the traditional winter-summer price spread narrowed, disincentivising stock replenishment in summer which in turn created more volatility risk during cold snaps.[4] With storage stuck in the cyclical pricing issue, Norwegian export levels matured, and Nord Stream flows constrained by capacity, opportunity grew to provide further balance to the UK and European markets.

LNG developed another trading avenue.

Whilst this historically came from Qatar, the constant chipping of Asian spot prices saw a new pattern; tankers as floating storage, sitting almost between regions waiting for a signal to unload cargoes in the most profitable market. The Arab Spring between 2010-12 offered opportunities to broader LNG development outside the Middle East, and the Fukushima tsunami of 2011 created a spike in demand as nuclear fell out of favour.

The chaos of seemingly multitudinous factors, as the market globalised and supply sources multiplied, supplied considerable opportunities; opportunities that can always, under the right conditions, pose serious risks. With the US investing heavily in LNG export facilities, the spectre of Russia closing off the European gas markets and a limited JKM market with poor returns (and heavier transport spend than competitors such as Australia and Malaysia) became tangible. Simply put, the US needed potential capacity across the entire globe in order to maximise opportunity and hedge risk. The cost of pressing prices down in the short term outweighed the costs of letting a status quo settle.

Naturally, whilst the US has had an astonishing increase in output, the other major players have also stepped up, exacerbating the LNG supply glut. This forms the pattern of 2019 and early 2020, strengthened by mild weather seen in both Asia and Europe; conditions which have meant volatility has been largely driven by geopolitical events. It provides an antonymic response to 2018, when the polar vortex known as “Beast from the East” stung the UK and Europe, and record EUA prices saw the entire energy complex keep rising month on month. Yet whilst it seems to be a market reaction to 2018, it is clear that external forces play a far larger part in gas security now.

Where once knowledge of the level of Rough storage could give you an indication for gas prices, now one needs to look to trilateral talks between the EU, Russia, and Ukraine; one needs to look to both the spread and churn across TTF, JKM, Henry Hub and NBP; one needs to look at global-level events like the COVID-19 pandemic; one needs to look for potential disruptors, like November’s US presidential election.

We are now firmly in a period of seeming chaos, where the sources of our energy supply are not as black and white as they once were. Conditions are less clear – we now see bearishness on under-supplied days, and the opposite when there is a glut. The conditions of depreciated pricing are unlikely to last; there are now more invested parties than ever. How they react, how competitors such as Russia and the US position themselves, will play a key part in gas pricing over the next five years.

In these conditions, it becomes imperative to have as much knowledge as possible of the shifting merit order of what drives prices, and to identify when these patterns change. Chaos without the right tools becomes a risk; if empowered, one can seize the opportunities such incredible complexity presents.

ZTP (www.ztpuk.com), the energy management and software

specialist

[1] In 1886 Karol Olszewski liquefied methane, the primary constituent of natural gas. However, it was not until 1940 that a full-scale LNG plant opened, in Cleveland, Ohio. A fire in 1944 saw 130 fatalities, and subsequently a considerable slowdown of development occurred. However, in 1959 a ship called Methane Pioneer made a delivery of LNG from the US to the UK. In 1964, the world’s first custom-made LNG carrier the Methane Princess made its first voyage

[2] The Nord Stream project was first mooted in 1997

[3] https://www.dw.com/en/germany-eu-decry-us-nord-stream-sanctions/a-51759319

[4] Frédéric Simon of Euractiv provides a more in-depth insight into this development here: https://www.euractiv.com/section/energy/news/the-evolving-role-of-gas-storage-in-europe/