If you or any of your employees travel for business purposes, the expenses accumulated can be used to claim tax relief.

Companies and self-employed professionals alike can claim tax relief on certain costs because these are necessary to generate profit, which is your taxable income. Alongside travel expenses, fundamental costs such as stock and raw materials, staff wages, marketing investments and many others can be filed in tax returns and essentially “written off”.

All these outgoings reduce a business’s taxable income and thus the process must be completed reliably. In this article, we introduce the dos and don’ts of claiming business travel expenses whether you’re filing for your company or yourself.

Do:

Understand what you can and can’t claimIt’s important to know what you can and can’t claim as travel expenses to avoid you facing fines and potentially more serious repercussions down the line.

Acceptable costs include transport, accommodation, and food whilst you’re away on business. Other necessities such as temporary car insurance or international phone contracts can also be included.

One important distinction to realise when it comes to travel expenses is that you can’t claim tax relief on your commuting costs, or the costs you incur whilst getting to and from your usual place of work. However, costs associated with the purpose of work itself can be used to claim tax relief.

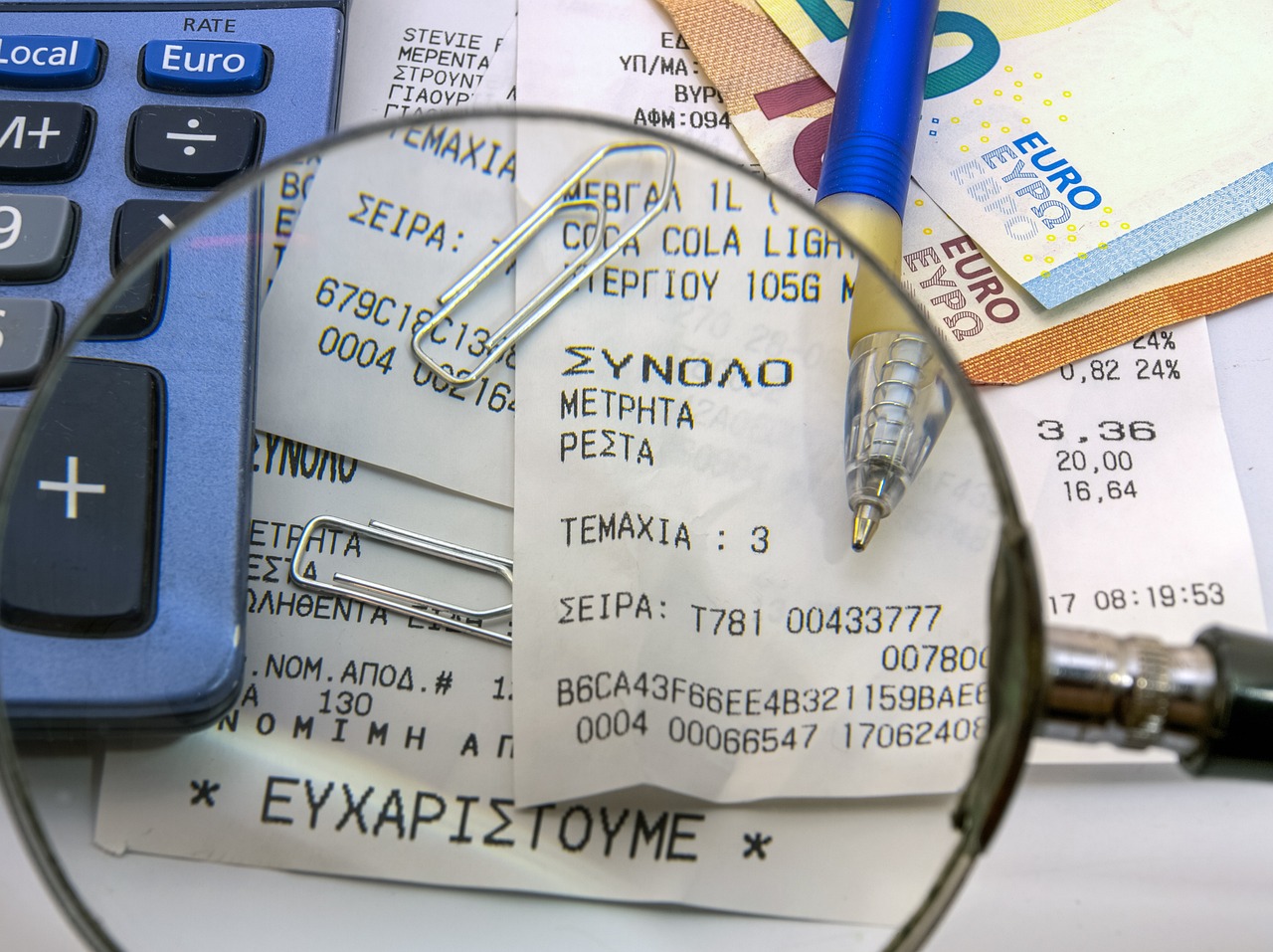

Keep receipts and invoicesYou should keep a record of all your travel investments and purchases in the form of receipts or invoices. This is so you can provide proof of your expenses if asked to by HMRC.

Records will also help you to keep track of your expenses and to submit an accurate tax return when you come to do it.

Stay up to date with legislationTax legislation can change from one financial year to the next, so ensure that you stay up to date with the relevant information and guidance.

This can be with regard to the costs associated with travelling abroad after significant changes like Brexit and factors such as tax thresholds for businesses and individuals that can change from year to year.

Don’t:

Mix personal and business costsAvoid mixing your personal and business finances to ensure that you can keep accurate records for tax purposes. You must also draw a clear line between leisure and business costs to ensure that you aren’t claiming tax relief on expenses that aren’t viable.

If you enjoy leisure travel while away for business, then those costs must be kept separate and can’t be claimed in your business tax filing.

Falsify your tax returnFalsification of your tax return figures can result in you being penalised for tax evasion. This is a serious offence and could see you facing jail time and some hefty fines if found guilty.

With this in mind, ensure that all your tax return assessments or forms are entirely accurate and don’t risk leaving income undeclared or trying to claim expenses that aren’t genuine.

Miss the deadline to fileThe deadline to submit your tax returns is usually in the year after the end of the accounting period that you are filing for. For the tax year just gone (2022/23), you must register for self-assessment by 5 October 2023 and submit your online tax return by 31 January 2024.

It’s different for businesses, with the deadline being 12 months from the end of the accounting year. In both circumstances, you may have to pay late fees for missing the deadline.